[No claim to originality in this post – just want some opinions on some common views on private debt, MMT, Keen’s work, and the FIRE sector]

Steve Keen argues that private debt was/is an important factor in the “Great Recession” and that aggregate demand equals income plus the change (or rate of change) in debt. (Keen presents a number of interesting GDP to debt, change in debt, employment and other comparisons, here is one example:)

This has sometimes led to debates with MMTers (much of which is being resolved already) regarding private credit-money creation netting to zero and related accounting aspects. A crude example:

“This is justified with vague references to “endogenous money”, another Keen shibboleth, with reasoning roughly as follows: Since money is endogenous, the banking system can add to demand by creating money “out of thin air”, without reference to anyone’s income or savings.” (This is here, there is some useful debate however. Also see comments on Steve’s page)

The debates seem to go a bit like this:

Keen’s statements on private debt.

Someone, usually an MMTer, pointing out it nets to zero, so doesn’t matter.

Then two counterpoints made- that either 1. the disconnect between Keen and MMT is possibly due to different aspects of dynamic modelling v. accounting, and/or 2. that the fact that private debt nets to zero on the books is hiding inflated asset values (I am not saying these are or are not right here, just running through the points. I will get back to this important conciliation of Keen and MMT in a later post).

Here my question is different.

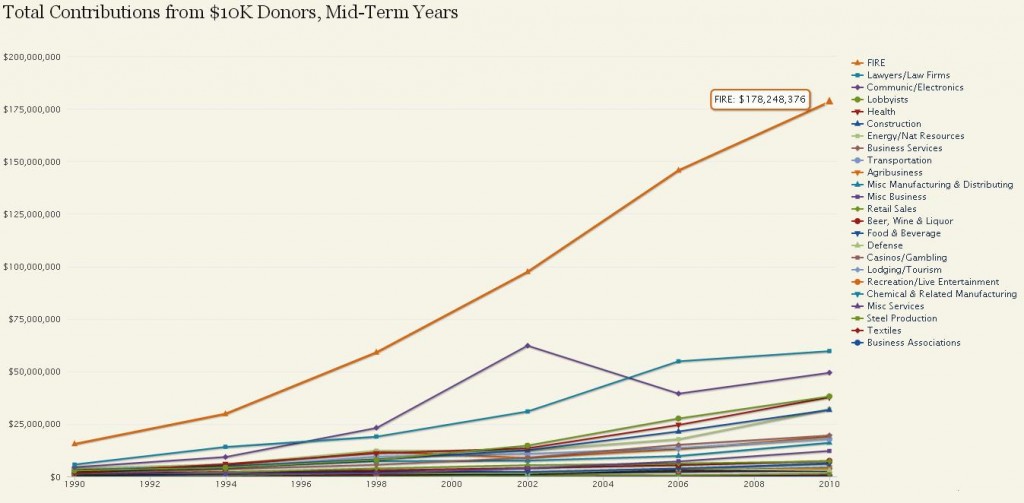

Regardless of the fact it nets to zero, to what extent is the total size of private debt, and especially its associated asset price increase and FIRE sector size – relative to the economy a problem? This seems to have very negative redistributive effects.

(source)

I know people like Hudson, Bill Black, Mosler, and many others from just about every “school” of thought have done work on this (sometimes with technical terms that can hide its relatedness to this discussion) and criticized the growth or dominance of the FIRE sector (as unproductive, unfair etc).

But somehow I do not see the point being associated to recent online debates concerning Keen’s emphasis on private debt and the MMT emphasis that it nets to zero (but that its total size is much larger than before).

The argument goes something like this:

It is common to see arguments that the larger economy suffers while the wealthy involved in the FIRE sector gain. Saying it nets to zero suggests that it is not so bad for the average Joe either – some win and some lose on mortgages, small business loans, and the many aspects of the financial sector that touch their lives, but it nets to zero.

Some asset price inflation effects are bad – instability is bad for almost everyone. But the point seems not to be made enough that the private debt|FIRE sector bubble is especially bad for the truly disenfranchised – the lower quintile who, unlike the middle class, have almost no direct exposure at all to the financial sector – they aren’t in the game at all, just left behind in a world of ever more Starbucks and middle and upper class goods that they have almost no connection to. No mortgages for them, even to lose out on, no business loans, etc. (They would probably love to be in bankruptcy court debating ownership of cars, houses, and credit card debt). Because private debt nets to zero, much of the middle class both loses and gains (at least sometimes) from financialization in complex ways. But at least they are in the game.

It seems those not even in the game of rising (but net zero) private debt just lose.

Again, no claim to originality in any of this. Just wanted to hear more about it in the context of debates on Keen/MMT and private debt netting to zero.

Clint

(http://www.incrediblecharts.com/economy/keen_debt_gdp.php)

(To see clear & interactive graph, go here: On FIRE: How the Finance, Insurance and Real Estate Sector Drove the Growth of the Political One Percent of the One Percent )

MMT’ers hold that private debt may net to zero but the level of private debt matters a whole lot, as do all Minskians. The MMT economist and Keen are pretty much in agreement over this to the best of my knowledge. Most of the controversy relates to accounting procedure and observing stock-flow consistency.

“MMT’ers hold that private debt may net to zero but the level of private debt matters a whole lot, as do all Minskians.”

I just don’t see an emphasis on this in their work.

Can you point me to MMT work that focuses on the downsides of private debt?

I know, for example, there were pre- 2007 crash MMT’ers highlighting private debt, don’t have sources at hand though.

What are some MMT works that really delve into the downsides (like the 2008 crash) of private credit-money viz. the nature of asset price inflation and financial instability?

[from Tom by email]

Bill Mitchell’s Fiscal sustainability and ratio fever is a pretty good summary. See also Randy Wray’s A Minskian Explanation of the Causes of the Current Crisis

Tom – The first example by Mitchell you give is almost entirely about public, sovereign debt. It mentions some good MMT insights on this. But it barely touches on private debt at all.

Wray, in the second example you give, in a short blog post makes the common observation that fraud and, over the long term, gradual erosion of regulatory oversight allowed ponzi finance to develop. No discussion of the role of private credit-money in this really though.

Surely there is some more detailed and meatier MMT literature on negative effects of private credit money creation (?) Regulatory structure can always be eroded over time, and not just because of private credit-money and private debt. What are the dynamics, though, where private credit-money and private debt help create asset price inflation and related problems, and how does MMT deal with this?

“Someone, usually an MMTer, pointing out it nets to zero, so doesn’t matter.”

Clint, you have to stop using comments made in blog threads as the basis for your analysis of MMT.

The guy you quoted there (vimothy)isn’t an ‘MMTer’. He’s either a mainstream/neoclassical or new keynesian type.

No MMT economist has EVER said that private debt doesn’t matter “because it all nets to zero”.

I used that qt as a quick kinda fun example, I am aware vimothy is not particularly mmt, and I am quite sure I have seen serious critiques by MMT’ers of Keen based on the view that he gets his accounting wrong.

Much of the interraction between Keen and MMT’ers happened in the blogosphere; since 2008 these things have been moving too fast to show up in a lot of journals, the work is collaborative online, and that is a good thing. But it also means real interplay of ideas (between Keen, Fullwiler and others) has played out online.

I am happy to read more “formal” work, but in this case I do not think my characterization is incorrect. Indeed, much of the Fields Insitute meeting involved precisely this topic, and Neil Wilson very usefully modified Keen’s work on private debt – precisly because MMT people were actively rejecting it because they thought Keen was/is wrong to say that private debt is somehow adding to aggreagate demand because…private debt nets to zero.

“in this case I do not think my characterization is incorrect.”

“usually an MMTer, pointing out it nets to zero, so doesn’t matter.”

MMTers go on and on about “unsustainable levels of private debt”/ private sector deficits with reference to sectoral balances and endogenous money, so there is no way your statement above can POSSIBLY be correct.

What I don’t get is why you don’t just ASK MMTers about this?

“MMTers go on and on…”

Wray, as a student of Minsky, writes on it. I am curious abouut more than just his work though.

“What I don’t get is why you don’t just ASK MMTers about this?”

Err – I believe I did. Here “Question on Steve Keen/MMT Discussion, Total Size of Private Debt|FIRE Sector Bubble” ! : )

Keen: “Firstly, a bit of background to explain why the seminar was held. It’s no secret that there has been some tension between myself and MMT in the past…The key issue here was my assertion that “aggregate demand equals income plus the change in debt” and the MMT focus upon sectoral balances in which “the sum of all sectoral balances is zero”

http://www.debtdeflation.com/blogs/2012/09/16/fields-institute-mmt-mct-seminar/

I don’t know exactly what the differences between Keen and the MMT lot were about.

MMT is very clear that loans create deposits thereby expanding the quantity of credit/money. MMT sectoral balance analysis is very clear that private sector net deficits are unsustainable.

Of course loans create deposits – and this nets to zero.

Bill Mitchell “All transactions between non-government entities net to zero”

http://bilbo.economicoutlook.net/blog/?p=14620

Posted by WARREN MOSLER on April 4th, 2010

http://moslereconomics.com/2010/04/04/tom-hickey-on-mmt/

“When banks create money by extending credit (loans create deposits), this occurs completely within the banking system and results in a liability for the bank (the deposit) and a corresponding asset (the loan). The customer has an asset (the deposit) and a corresponding liability (the loan). This nets to zero.”

But this makes explaining why High Private-Debt to GDP ratios are bad a little complicated – not impossible, just not as clear.

Anonymous – You might find some of this useful/interesting

http://clintballinger.edublogs.org/2012/12/22/post-keynesianism-mmt-100-reserves-project-post-no-2/#comment-192

http://www.levyinstitute.org/pubs/wp_711.pdf

Global Financial Crisis: A Minskyan Interpretation of the Causes, the Fed’s Bailout, and the Future

by

L. Randall Wray

Levy Economics Institute of Bard College

“This paper provides a quick review of the causes of the Global Financial Crisis that began in 2007. There were many contributing factors, but among the most important were rising inequality and stagnant incomes for most American workers, growing private sector debt in the United States and many other countries, financialization of the global economy (itself a very complex process), deregulation and desupervision of financial institutions, and overly tight fiscal policy in many nations.”

Some more by Wray:

http://neweconomicperspectives.org/2011/06/recent-usa-sectoral-balances-goldilocks.html

http://www.economonitor.com/lrwray/2012/04/02/krugman-versus-minsky-who-should-you-bank-on-when-it-comes-to-banking/

What do Banks do, What should banks do?

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1665450

Something by Bill Mitchell:

http://bilbo.economicoutlook.net/blog/?p=21467

Yes, Wray, as a student of Minsky, has some great stuff in this area – more on that in another post.

I would love some non-Wray stuff as well.

Thanks! And relax : ) There needs to be better understanding between MCT and MMT and a few other areas. All I am doing is working towards that.

“The new road to serfdom: An illustrated guide to the coming real estate collapse”

By Michael Hudson

From the May 2006 issue of Harper’s

Clint, it is totally obvious by DEA that within a sector, the accounts have to balance so the RHS = LHS. That means net zero. The MMT contribution to show that when the liability is on the side of govt and the asset on the side of non-govt, then there is net zero only in the case of a balanced budget, but the stock of previously created $NFA as cumulative deficits remains as the national debt/saving. MMT economists accept MCT analysis of non-govt sector, which sums to zero, so it doesn’t say much about it but presumes the work already done by others. No need to repeat that. The MMT economists focus on the area of vertical-horizontal not perviously explored.

“MMT economists accept MCT analysis of non-govt sector, which sums to zero, so it doesn’t say much about it but presumes the work already done by others”

But were there not some recent disagreements? That perhaps in a way it does not sum to zero (for reasons discussed – dynamic v accounting perspective, or mark to myth etc).

And as discussed, if it does sum to zero, how/ why then does it have negative effects?

This is still an ” area of vertical-horizontal” not sufficiently explored it seems.

And as discussed, if it does sum too zero, how/ why then does it have negative effects?

It’s necessary to deconstruct the aggregated debt wrt quality (sustainability) in addition to just looking at the quantity in aggregate. Just because the debt nets to zero doesn’t imply that it is payable. It just means that the loans are owned by net savers and owed by net borrowers, so that the aggregated net is zero.

If the net borrowers are not in a position to perform, then the loans become non-performing and the amount of the non-performing loans has implications like debt-deflation. It’s only neoclassical economists who think that since private debt nets to zero it is economically irrelevant. Conversely, Keynesians hold that quantity and quality of private debt is crucial in economics and cannot be ignored as the neoclassical modeling does. This is especially true of the Minsky camp, which includes MMT economists, Steve Keen, Michael Hudson and many others.

Thanks Tom! That’s exactly the kind of language I am trying to get these ideas into, sort of the purpose of my site.

I agree there is a Minskyian view that cuts across a lot of other camps.

A question though – it seems Wray (for example) or in your answer here, there is a focus on the asset side – the quality of private debt, which leads to regulatory solutions (which I agree with).

But I would like to see more attention from MMT on long term structural rather than piecemeal regulatory solutions to problems of private credit-money, where under the current system broad monetary aggregates depend almost entirely on bank loans and changes in banks’ willingness to lend lead to booms and busts and affect nominal aggregate demand.

Why should the government pay to regulate the unstable private use of its own creation (money)?

Why not start there rather than focus on regulatory solutions? Especially as MMT more than anyone knows that the government can create any monetary aggregates needed. The gov can easily take care of the quantity, and what private debt there is (for capital investment projects that pay interest or other rewards to investors who take all the risk as well) will be of very high quality.

Right quantity & excellent quality = a win/win situation it seems.

Wray is considered the expert on Minsky, since Minsky was Randy’s thesis advisor. All the MMT economists are experts on banking, and Warren is a principal in a small bank. They all agree that the place to regulate is the asset side rather than the liability side, especially in a time of Ponzi finance. But really to prevent Ponzi finance from developing. Warren has said quite a bit about this in the comments on his blog and his proposals for reforming finance are pretty clearly designed to get banks back to financial intermediation and risk management and out of risk taking. Randy Wray and Bill Black have also written extensively about the criminogenic environment in banking that needs to be eliminated, too. All in all, I’d say that the MMT and UMKC economist are farther on top of finance as a whole in a comprehensive than anyone else or any other group.

Tom, do you think there is any overlap in, for example, Mosler’s suggestions for bank reform and plans like positivemoney or Kotlikoff’s?

I think there is some, though other’s don’t. Seems to me there is some shared intent and even method, just in different language.

I know you are familiar with these but the links are here for comparison by others

http://www.huffingtonpost.com/warren-mosler/proposals-for-the-banking_b_432105.html

http://www.positivemoney.org/wp-content/uploads/2010/11/NEF-Southampton-Positive-Money-ICB-Submission.pdf

“I would love some non-Wray stuff as well.”

Clint, I can give you some links but your site won’t accept comments with http web addresses

Hello – Thanks. It has been accepting them no problem, it just asks me to moderate them (you can see some a few posts up).

Did you try and there was some problem? Sorry about that, could you try one more time?

Bill Mitchell:

bilbo.economicoutlook.net/blog/?p=277

bilbo.economicoutlook.net/blog/?p=5240

bilbo.economicoutlook.net/blog/?p=5098

bilbo.economicoutlook.net/blog/?p=9075

e1.newcastle.edu.au/coffee/pubs/wp/2008/08-10.pdf

e1.newcastle.edu.au/coffee/pubs/wp/2002/02-11.pdf

Scott Fullwiler:

papers.ssrn.com/sol3/papers.cfm?abstract_id=1658234

neweconomicperspectives.org/2011/06/sector-financial-balances-model-of.html

neweconomicperspectives.org/2013/01/functional-finance-and-the-debt-ratio-part-iv.html

neweconomicperspectives.org/2012/04/krugmans-flashing-neon-sign.html

Stephanie Kelton:

neweconomicperspectives.org/2012/09/bird-brains-from-austerity-to-prosperity.html

Michael Hudson:

michael-hudson.com/2012/09/incorporating-the-rentier-sectors-into-a-financial-model-3/

Eric Tymoigne:

neweconomicperspectives.org/2009/06/question-how-big-is-debt-problem-answer.html

http://www.levyinstitute.org/publications/?docid=1333

James Galbraith:

http://www.levyinstitute.org/publications/?docid=1274

Steve Keen and Matheus Grasselli integrate aspects of MMT in this paper:

http://www.math.mcmaster.ca/~grasselli/KeenGrasselli2012EuropeanDisunionAndEndogenousMoneyFinal.pdf

Text from 1999 by Wynne Godley and Randall Wray:

http://www.levyinstitute.org/pubs/pn99_4.pdf

Releated Levy Institute ebook:

http://www.levyinstitute.org/pubs/eBook_2

Bill Mitchell:

bilbo.economicoutlook.net/blog/?p=277

bilbo.economicoutlook.net/blog/?p=5240

bilbo.economicoutlook.net/blog/?p=5098

bilbo.economicoutlook.net/blog/?p=9075

e1.newcastle.edu.au/coffee/pubs/wp/2008/08-10.pdf

e1.newcastle.edu.au/coffee/pubs/wp/2002/02-11.pdf

Scott Fullwiler:

papers.ssrn.com/sol3/papers.cfm?abstract_id=1658234

neweconomicperspectives.org/2011/06/sector-financial-balances-model-of.html

neweconomicperspectives.org/2013/01/functional-finance-and-the-debt-ratio-part-iv.html

neweconomicperspectives.org/2012/04/krugmans-flashing-neon-sign.html

Stephanie Kelton:

neweconomicperspectives.org/2012/09/bird-brains-from-austerity-to-prosperity.html

Michael Hudson:

michael-hudson.com/2012/09/incorporating-the-rentier-sectors-into-a-financial-model-3/

Eric Tymoigne:

neweconomicperspectives.org/2009/06/question-how-big-is-debt-problem-answer.html

http://www.levyinstitute.org/publications/?docid=1333

James Galbraith:

http://www.levyinstitute.org/publications/?docid=1274

Steve Keen and Matheus Grasselli integrate aspects of MMT in this paper:

http://www.math.mcmaster.ca/~grasselli/KeenGrasselli2012EuropeanDisunionAndEndogenousMoneyFinal.pdf

Text from 1999 by Wynne Godley and Randall Wray:

http://www.levyinstitute.org/pubs/pn99_4.pdf

Releated Levy Institute ebook:

http://www.levyinstitute.org/pubs/eBook_2

Thanks – great resource for everyone here!

http://www.levyinstitute.

org/pubs/eBook_2012.pdf

I don’t think that link is working

That last one is important so I’m posting the website link too:

Levy Economics Institute, Monetary and Financial Structure Research Program:

Beyond The Minsky Moment

Dimitri B. Papadimitriou, Jan Kregel, James K. Galbraith, L. Randall Wray, Greg Hannsgen, Marshall Auerback, Jörg Bibow, Steven M. Fazzari, Michael Hudson, Thorvald Grung Moe, Robert W. Parenteau, Sunanda Sen, Willem Thorbecke, Éric Tymoigne

http://www.levyinstitute.org/publications/?docid=1520

This may have been stated already, but is important enough to be said again.

The big problem with debt occurs when it bears interest.

Any rate of interest is a doubling period. This means that interest bearing debt accumulates exponentially.

The real economy, however, grows, not exponentially, but in a S-curve.

When the two curves are plotted against each other, it is easy to see the problem.

Interest bearing debts will always outstrip the ability of the real economy to pay.

The only question is how won’t they be paid.

Will creditors be permitted to foreclose on debtors, seizing the assets pledged as collateral, polarizing the economy, changing it’s shape & character.

Or will the debts be cancelled.

As it is difficult, if not impossible, to cancel the debts owed to the 1%, and as it is much easier to cancel debts owed to oneself, an argument can easily be made for either publicly owed banking operated as a public utility or for equity banking (public or private).