[Prologue to this post]

[Prologue to this post]

MODERN MONETARY THEORY (MMT) notes correctly that money is a creature of the state, and that important macroeconomic and policy conclusions follow from this understanding, e.g., sovereign states are not revenue constrained and spending is primarily limited by inflation. Taxes give value to state money and maintain its value (i.e., inflation can be controlled through taxes).

One (among many) key policy insight is that a job guarantee is possible. A job guarantee not only achieves what many think should for myriad social reasons be a primary goal of macroeconomics but also further creates a buffer stock (the most useful one of any imaginable given the social reasons just mentioned) that achieves an additional primary macroeconomic policy goal – stability.

However, there is no state that operates under a pure state system of money. Most of what serves as money in most banking systems in the world is privately created credit money.

We can compare the current most common banking system with a pure state system of money:

|

PURE STATE SYSTEM OF MONEY

|

|

CURRENT SYSTEM

|

|

|

|

|

|

|

|

Money is a creature of law.

|

|

Money is a creature of law.

|

|

|

|

|

|

|

|

Money is valued because it can be used to extinguish debt to its issuer.

|

|

Money is valued because it can be used to extinguish debt to its issuer.

|

|

|

|

|

|

|

|

The issuer is the state.

|

|

The issuers are the state and private banks.

|

|

|

|

|

|

|

|

Taxes move resources into the public sector

|

|

Taxes move resources into the public sector. Loan repayments move resources into the private (often finance) sector

|

|

|

|

|

|

|

This raises important questions. If the state is not a monopoly issuer of money, do other neo-chartalist/functional finance/MMT insights hold?

A sovereign currency issuer is still not revenue constrained. And it can still spend towards full employment and other public purposes.

One major worry, however, is whether, because the state does not have a monopoly on money creation, it can set prices in the ways MMT argues. Especially, trying to do so while not having a monopoly on money creation may be inflationary even with otherwise appropriate taxation.

So what are the possibilities? Let’s imagine a system where the state truly has a monopoly on money creation. The state creates money and a payment system. There can still be loans and borrowing, but borrowing will be from someone else giving up use of their money, just as if you loaned a friend a tenner from your pocket. The risks and rewards of this can be pooled for large capital projects.

Let’s ignore the sometimes heard first criticism of this: “deflation!”. Imagine moving to this system in a portfolio neutral way, so that essentially all M’s (M2 and beyond) are, through bookkeeping entries, changed to M1 in a one-off system change. (There are also worries that this “creation” of M1 would be inflationary by others; they seem not to understand what “portfolio neutral” means.)

The obvious advantage is that bank runs will be a thing of the past – assuming a few other obvious regulatory moves (on securities and such) and all bad loans will be losses to individual investors, never systemic (this incidentally puts the incentives for loan quality and underwriting in the right places, raising the quality of loans in the first place). If Joe doesn’t pay you back his tenner, you are the only loser and there is no amplification of this loss. Cascading liquidity crises simply are not possible under this system.

THERE ARE THEN TWO RELATED objections – first, that without continued private credit money creation, this new system would still be deflationary. The related objection is that the “dynamic” private credit money system is behind much innovation and growth, and this would be lost.

On the first – this is interesting as it highlights a major question on the purpose and effectiveness of government. If money is a creature of the state, and a sovereign government cannot be insolvent, then it cannot be that a pure state money system will be deflationary because there is not enough money. The state can create as much money as it needs to re-inflate an economy.

The worry, then, must be that somehow the state will not be able to get the money it can endlessly create into the right hands, while somehow the private credit money system does. This highlights the fact that the worries about abolishing private bank credit money creation cannot truly be about the quantity of money or credit but about how and by whom the money and credit needed to keep the economy from deflation is created and spent into the economy.

This gets to much of what is the core concern of a pure state money system by both advocates and detractors alike, although often they are not nearly as clear as they could be about it.

What serves the public purpose more- having only the state create and spend money and credit into the economy, or allowing the private sector to control part of this public utility?

We already saw that one concern is that private credit money may force a tradeoff between public spending and inflation. What are some other potential costs? What is the real value and real cost of funding borrowers’ needs by allowing credit money to be created privately?

Costs

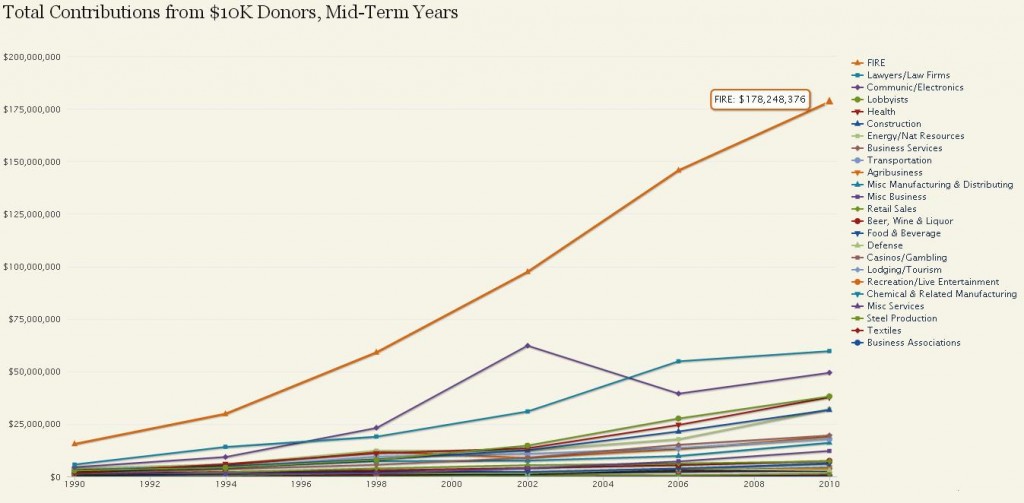

– We already mentioned policy space – the current system of substantially privatizing a public utility seems to move many resources into the private finance sphere, arguably reducing the policy space for public purpose (job guarantee, education, health care, etc.).

– A major tenet of MMT/Functional Finance is that it is how we utilize real resources now that matters, not deficits, and that we cannot borrow from the future. Money creation through credit likewise does not magically transport future resources to the present, it can only redistribute existing resources. Ceteris paribus (on taxes, policies, and who is utilizing the money) there is X amount of money that can be spent into an economy without inflation. Credit money creation can only redistribute this X amount of money and the real resources it affords (or cause inflation), and it is not clear that the private system does this in an equitable, nor necessarily the most efficient, manner.

– Where private money creation is combined with maturity transformation, as in the shadow banking system, money market and many bond funds, there is a distorted yield curve on interest rates. Some, especially Austrians, view this as leading to market inefficiencies in the long run, in addition to being severely unstable. This system allows narrow private benefits at the expense of widespread socialized costs and chronic instability (Maurice Allais’s non-Austrian work on this seldom receives the attention it merits, especially in the English speaking world.)

– Instability – allowing credit money has time and again led to intense and highly damaging episodes of instability. Diamond & Dybvig formalized the multiple equilibrium nature of banks runs; there is no stable equilibrium of credit-money creating banks without a lender of last resort. The true costs of instability are seldom weighed as a whole, nor presented in a way the general public can understand. What is the true and total cost to the public of the crises of 1907, 1929, 2008, the many smaller crises such as S & L, the Japanese asset price bubble, LCTM, banking crises in Finland, Sweden, Asia, Russia, Mexico, Argentina, Ecuador, Uruguay, and throughout Europe, the dot.com and housing bubbles, the bailouts of AIG, Northern Rock etc.? Is it truly, with proper accounting, worth the growth that some defend the current private system as promoting? On balance, a stable economy without socialized losses may be more dynamic and productive and allocate the real resources of the economy more efficiently than the current system, if judged with proper accounting standards.

– This leads to another point: Reality. The government already funds the banking system, both with occasional trillion dollar bailouts and on a daily basis. “Private” systems have shown time and again to be backstopped by governments (e.g., the U.S.and U.K.bailouts). The US government has proven to de facto guarantee the entire U.S. financial system (and the UK government the British system and so on), and lenders know it, much to their advantage (and distortion of the real economy). As someone else has written* “When A guarantees B’s liabilities, B needs to be on A’s balance sheet. This is accounting 101, folks.”

– MMT very correctly insists that an economic theory, to be worth considering at all, must at a minimum match real bookkeeping. To meet basic standards of accounting we would have to “[c]onsolidate the entire financial system onto USG’s balance sheet. While we’re at it, merge the Fed, Treasury, Social Security and Medicare into one financial entity. Clean up the whole mess of interlocking quasi-corporations. The US government is one operation. It should have one balance sheet.”* Again, this is Accounting 101.

IF IT IS INDEED THOUGHT that the benefits of credit money creation are worth the instability and other costs this system incurs on society, this raises another question:

Can a government duplicate credit money creation while distributing the gains and losses more equitably (i.e., socialized gains as well as socialized losses, instead of the current system that is mostly private gain and socialized loss)?

As we noted, in the current system, in addition to the money that people and businesses already have, they often want more money for productive and socially useful purposes. We further noted that there are two ways to get this money:

1. through other people loaning money that they already have or

2. through private credit money creation.

The first is not problematic, while the second is.

Would it be possible for the state to maintain something like the current system operationally, just making the parts of it that already are backstopped by the state actually state? This raises questions: Could this system be kept apolitical? (this potential political downside has to be weighed against the already existing downside: our private system has already experienced extensive regulatory capture). Could it be kept as competitive as it is now? Would it be as unstable as now with a truly “risk-neutral non-liquidity-constrained economic agent” (that is, the government) behind it?

This system could be thought of in this way: Individuals and businesses that desire more money for productive purposes than they can get from other money holders are granted the privilege of additional state money created just for them; alongside this special privilege they voluntarily accept an additional tax burden to maintain the value of the money system. Let’s add that (in bold) into the comparison we made above between a pure state theory of money and the current state/private hybrid system:

|

PURE STATE SYSTEM OF MONEY

|

|

CURRENT SYSTEM

|

|

|

|

|

Money is a creature of law.

|

|

Money is a creature of law.

|

|

|

|

|

Money is valued because it can be used to extinguish debt to its issuer.

|

|

Money is valued because it can be used to extinguish debt to its issuer.

|

|

|

|

|

The issuer is the state.

|

|

The issuers are the state and private banks.

|

|

|

|

|

Taxes move resources into the public sector

|

|

Taxes move resources into the public sector. Loan repayments move resources into the private finance sector

|

|

|

|

|

Some businesses or individuals want to borrow money. There are two ways to do so. One is for others to loan their existing money. This may be too restrictive and keep growth at suboptimal levels. The other is for new money to be created.

|

|

Some businesses or individuals want to borrow money. There are two ways to do so. One is for others to loan their existing money. This may be too restrictive and keep growth at suboptimal levels. The other is for new money to be created.

|

|

The government creates this new money. The individual or business pays an additional tax for this privilege.

|

|

Private banks create this new money. The individual or business pays the bank interest for this privilege. |

|

The “lender of last resort” is the lender of first resort. There are both private and social gains and corresponding private and social losses.

|

|

Privately created money is inherently unstable without a lender of last resort. The government is the lender of last resort. There are private gains and socialized losses

|

| As a monopolist over its currency, the state has the power to set prices, including both the interest rate and how the currency exchanges for other goods and services. As a monopolist, the state can fund a job guarantee and other public goods without causing inflation. |

|

In a system with “redundant currencies” (Innes 1914) the state may not be able to achieve macro policy goals and prevent inflation simultaneously |

|

|

|

| The system is inherently stable. Stability leads to optimal investment, insurance, and allocation decisions and optimal long-term growth and welfare. Redistribution of private and social gains and losses is minimized. |

|

The system is inherently unstable and uncertain. Chronic instability and uncertainty leads to suboptimal investment, insurance, and allocation decisions and suboptimal long-term growth. The system continuously transfers unearned wealth into the private (often finance) sector, furthering suboptimal economic performance and incentivizing rent-seeking and regulatory capture. |

|

|

|

Currently, many of the most important neo-chartalist/MMT functional finance insights are not applied in the US, UK, and other countries, and they are clearly desperately needed. However, even if they were applied, the private credit money system would still interfere, possibly greatly, and would still lead to the same type of instability it always and everywhere has. The ongoing “crash” of 2008 seems to be fundamentally and deeply related to issues of private credit money creation, not the equally important issues of state money that MMT has so usefully brought to light. A true state theory of money must address the fundamental instability and inequitable nature of what Innes (1914) called a situation of “redundant currencies”, a system of both state and private money creation, and to be fully consistent, integrate it into its framework completely. It is not enough to “agree with the MCT folks” (or vice versa). The two must be a seamless whole.

~~~

* This wording is by an arch-Austrian good with pithy wording; I am not “Austrian” but on this issue, at least, he has interesting observations.

(Previous post: TOWARDS A PURE STATE THEORY OF MONEY, PROLOGUE: A NOTE ON KNAPP & INNES )