[No claim to originality in this post – just want some opinions on some common views on private debt, MMT, Keen’s work, and the FIRE sector]

Steve Keen argues that private debt was/is an important factor in the “Great Recession” and that aggregate demand equals income plus the change (or rate of change) in debt. (Keen presents a number of interesting GDP to debt, change in debt, employment and other comparisons, here is one example:)

This has sometimes led to debates with MMTers (much of which is being resolved already) regarding private credit-money creation netting to zero and related accounting aspects. A crude example:

“This is justified with vague references to “endogenous money”, another Keen shibboleth, with reasoning roughly as follows: Since money is endogenous, the banking system can add to demand by creating money “out of thin air”, without reference to anyone’s income or savings.” (This is here, there is some useful debate however. Also see comments on Steve’s page)

The debates seem to go a bit like this:

Keen’s statements on private debt.

Someone, usually an MMTer, pointing out it nets to zero, so doesn’t matter.

Then two counterpoints made- that either 1. the disconnect between Keen and MMT is possibly due to different aspects of dynamic modelling v. accounting, and/or 2. that the fact that private debt nets to zero on the books is hiding inflated asset values (I am not saying these are or are not right here, just running through the points. I will get back to this important conciliation of Keen and MMT in a later post).

Here my question is different.

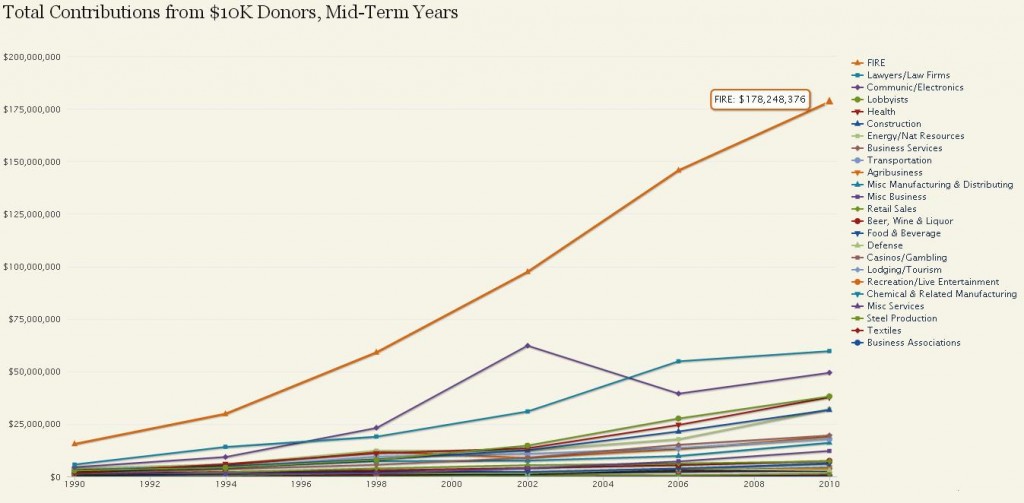

Regardless of the fact it nets to zero, to what extent is the total size of private debt, and especially its associated asset price increase and FIRE sector size – relative to the economy a problem? This seems to have very negative redistributive effects.

(source)

I know people like Hudson, Bill Black, Mosler, and many others from just about every “school” of thought have done work on this (sometimes with technical terms that can hide its relatedness to this discussion) and criticized the growth or dominance of the FIRE sector (as unproductive, unfair etc).

But somehow I do not see the point being associated to recent online debates concerning Keen’s emphasis on private debt and the MMT emphasis that it nets to zero (but that its total size is much larger than before).

The argument goes something like this:

It is common to see arguments that the larger economy suffers while the wealthy involved in the FIRE sector gain. Saying it nets to zero suggests that it is not so bad for the average Joe either – some win and some lose on mortgages, small business loans, and the many aspects of the financial sector that touch their lives, but it nets to zero.

Some asset price inflation effects are bad – instability is bad for almost everyone. But the point seems not to be made enough that the private debt|FIRE sector bubble is especially bad for the truly disenfranchised – the lower quintile who, unlike the middle class, have almost no direct exposure at all to the financial sector – they aren’t in the game at all, just left behind in a world of ever more Starbucks and middle and upper class goods that they have almost no connection to. No mortgages for them, even to lose out on, no business loans, etc. (They would probably love to be in bankruptcy court debating ownership of cars, houses, and credit card debt). Because private debt nets to zero, much of the middle class both loses and gains (at least sometimes) from financialization in complex ways. But at least they are in the game.

It seems those not even in the game of rising (but net zero) private debt just lose.

Again, no claim to originality in any of this. Just wanted to hear more about it in the context of debates on Keen/MMT and private debt netting to zero.

Clint

(http://www.incrediblecharts.com/economy/keen_debt_gdp.php)

(To see clear & interactive graph, go here: On FIRE: How the Finance, Insurance and Real Estate Sector Drove the Growth of the Political One Percent of the One Percent )